Once You Closw Chase Savinhs You Cannot Open Again

Before you close a Chase credit card, y'all should retrieve long and hard about why you're considering this motility. In the meantime, you should also expect into the alternative steps y'all could take that could modify up your credit game for a goal (i.east., fugitive an annual fee) without all the downsides that come with closing your account completely.

While ditching your carte du jour might ultimately make sense, the Chase 5/24 rule and other limitations from Chase can brand getting a rewards credit card you've had in the past much more hard if you change your listen.

This guide aims to explain how to close a Chase credit carte account, equally well every bit some alternating steps you could take instead.

How to close a Chase credit card

Hunt doesn't make it hard to close your credit card business relationship if that's what you actually want to practise. Here are the steps y'all can have to shut downward your credit card account altogether.

Call Chase

If you lot're wondering how to close a Chase account over the telephone, you can brainstorm the process past calling the client service number on the dorsum of your credit card. In one case you get a customer service representative ready to assistance you, permit them know you lot want to close your credit card account altogether. While y'all're on the telephone, you'll need to share data like your ZIP code, name and account number to prove your identity.

If you don't desire to call the number on the back of your Chase credit card, yous tin likewise reach Chase client service at i (800) 432-3117.

Cancel your carte online

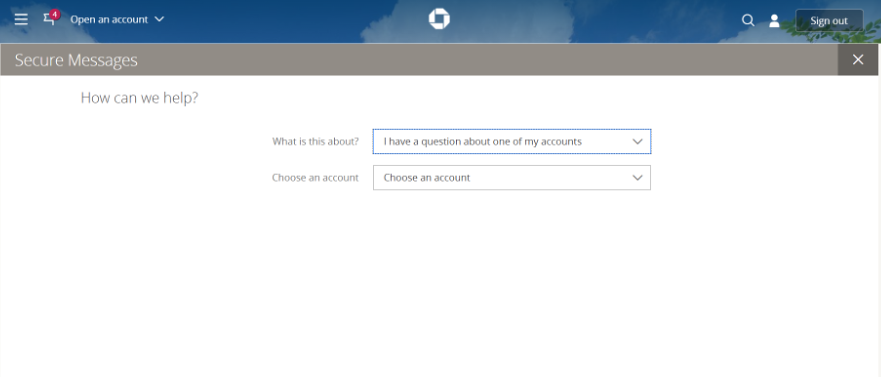

Chase doesn't offer an online chat feature similar American Express does, but they do offer a secure way for y'all to contact them online. If yous depository financial institution or manage your credit carte business relationship using Chase.com, you can ask Chase to cancel your card through their secure messaging system.

You'll have to log into your Chase online account management folio to do and then. From there, head to your "secure messages" from the drop-downwardly menu on the left side of the screen. Then, select the option that says "I take a question about one of my accounts."

At that point, you'll select the credit card business relationship number for the carte you desire to shut and write a simple bulletin stating y'all want your account airtight and can provide additional information if necessary.

Send a alphabetic character in the mail

Yous can too transport a letter of the alphabet to Chase in the mail, which may brand sense if you don't manage your account online or feel like calling in to speak to someone. In your letter of the alphabet, you'll desire to include your name, account number, address and a cursory bulletin that says y'all want your Chase credit card account closed right away.

If you are wondering how to close a Chase credit carte du jour via snail postal service, you can use the following accost:

National Bank By Mail

P.O. Box 6185

Westerville, OH 43086

Does closing a Chase credit menu affect your credit score?

Due to the way credit scores are determined, closing a credit card account can hurt your credit score—even if the card is rarely used. There are ii main reasons this is true.

Outset, closing a credit card business relationship shortens the boilerplate length of your credit history, which is used to make up 15 percentage of your FICO score. 2nd, and near importantly, closing a credit card can reduce the amount of open up credit you accept and enhance your credit utilization considerably.

Since this factor makes up 30 pct of your FICO score, raising your credit utilization rate through account closure should be your biggest concern. But, how would this gene come up into play?

Imagine for a moment you currently have two credit cards—a Chase credit card and a Citi credit carte du jour. Each ane has a limit of $10,000, so your total credit is $20,000.

Now imagine yous just paid off the remainder on your Chase credit card, but yous yet accept $4,000 in debt on your Citi credit card. At this moment in fourth dimension, your credit utilization rate is 20 percent since yous owe $4,000 with a full credit limit of $20,000. However, closing your Chase credit carte would get out you lot owing $4,000 in debt beyond $10,000 in total credit limits, and then your credit utilization rate would increase to xl percentage overnight.

Options to consider before canceling your Chase credit card

If you are worried near damaging your credit score or you lot don't necessarily want to ditch your Chase credit card altogether, there are a few smart options to consider:

Inquire for Chase to waive the annual fee

If you are canceling your credit card because you don't want to pay an annual fee, keep in mind that you can always call Chase and enquire them to waive the fee. They may or may not corroborate your request, but the worst they can exercise is say "no."

Request a production modify

You lot can too asking a product modify from ane Hunt credit card to another, a popular move among those who want to avoid paying high almanac fees on rewards credit cards from Chase.

For example, you could phone call and ask to switch from the Chase Sapphire Reserve® with its $550 annual fee to the Chase Sapphire Preferred® Card with its $95 annual fee. This would allow yous save hundreds of dollars per year, yet you could keep earning points for travel in the Chase Ultimate Rewards plan.

You could even product change to a cash dorsum credit bill of fare with no annual fee, such as the Chase Liberty Unlimited®.

Safely store your credit card

Also, recall that you don't have to close your credit card just because you don't desire to use it. You lot can store your card in a rubber or a sock drawer, and you don't accept to become information technology out unless y'all really want to.

By keeping your credit card open without whatever activeness, the business relationship is still helping to lengthen your average credit history.

Closing a Hunt credit card: FAQ

Can I close a Chase credit card with an outstanding balance?

You lot can abolish a credit bill of fare with an outstanding residue. However, you lot will still take to repay your remaining balance based on your credit carte du jour's current terms and conditions.

Volition Chase still charge me interest on a airtight business relationship?

Hunt volition still accuse interest on remaining balances even afterwards you close your credit bill of fare business relationship. If they are going to heighten your interest charge per unit, they are required to give you 45 days of notice before they do.

Tin can y'all reopen a closed chase credit card account?

You cannot reopen a closed Chase credit card account, but you can utilize for some other Chase credit menu or the i you had before. Just remember that Chase has rules that limit who can and cannot get their credit cards or earn a sign-upwardly bonus.

For starters, the Chase 5/24 rule says you cannot become approved for a Chase card if yous have had v or more credit cards within the terminal 24 months. Further, Hunt has specific rules that govern their families of cards. If y'all read the fine impress on the Hunt Sapphire Reserve®, for example, you'll notice information technology says:

"The product is non available to either (i) current cardmembers of any Sapphire credit menu, or (ii) previous cardmembers of whatsoever Sapphire credit carte du jour who received a new cardmember bonus inside the last 48 months. If y'all are an existing Sapphire customer and would like this product, delight call the number on the back of your card to meet if you are eligible for a production change. Yous will not receive the new cardmember bonus if you change products."

The bottom line

Closing a credit card can sometimes be the right motility, but there are definitely situations where you're ameliorate off switching products or stashing your card away in a sock drawer. Make sure yous consider all the options, too equally potential consequences y'all'll confront if you close your Hunt menu account for skilful.

In that location'southward no real "right" or "incorrect" reply that applies to anybody, merely you should make an informed decision.

Source: https://www.bankrate.com/finance/credit-cards/how-to-close-chase-account/

Post a Comment for "Once You Closw Chase Savinhs You Cannot Open Again"